Which AI Stocks Are Turning Hype Into Revenue?

For Nvidia, Microsoft and others, AI will remain a tailwind in 2024.

The biggest names in artificial intelligence are once again surpassing expectations for quarterly earnings.

In April, we previewed what Morningstar analysts thought about the main AI players ahead of first-quarter earnings. With earnings season winding down, we checked in to see which stocks turned the hype into revenue and growth during the quarter.

Key AI Stocks

- Adobe ADBE

- Advanced Micro Devices AMD

- Amazon.com AMZN

- Arista Networks ANET

- Arm Holdings ARM

- Broadcom AVGO

- Intel INTC

- Marvell Technology MRVL

- Microsoft MSFT

- Nvidia NVDA

AI Stock Performance

After a dropoff in April, strong earnings reports drove AI stocks to rebound in May. The Morningstar Global Next Generation Artificial Intelligence Index returned 4.3% over the month, just shy of the 4.7% gain on the Morningstar US Market Index.

One-Year Performance of AI Stocks

The biggest winner was Nvidia, which rallied 9.3% the day after earnings to end the past month up 26.9%. Arm Holdings (which climbed 19.1%) and Arista Networks (which gained 16.0%) also saw strong rallies.

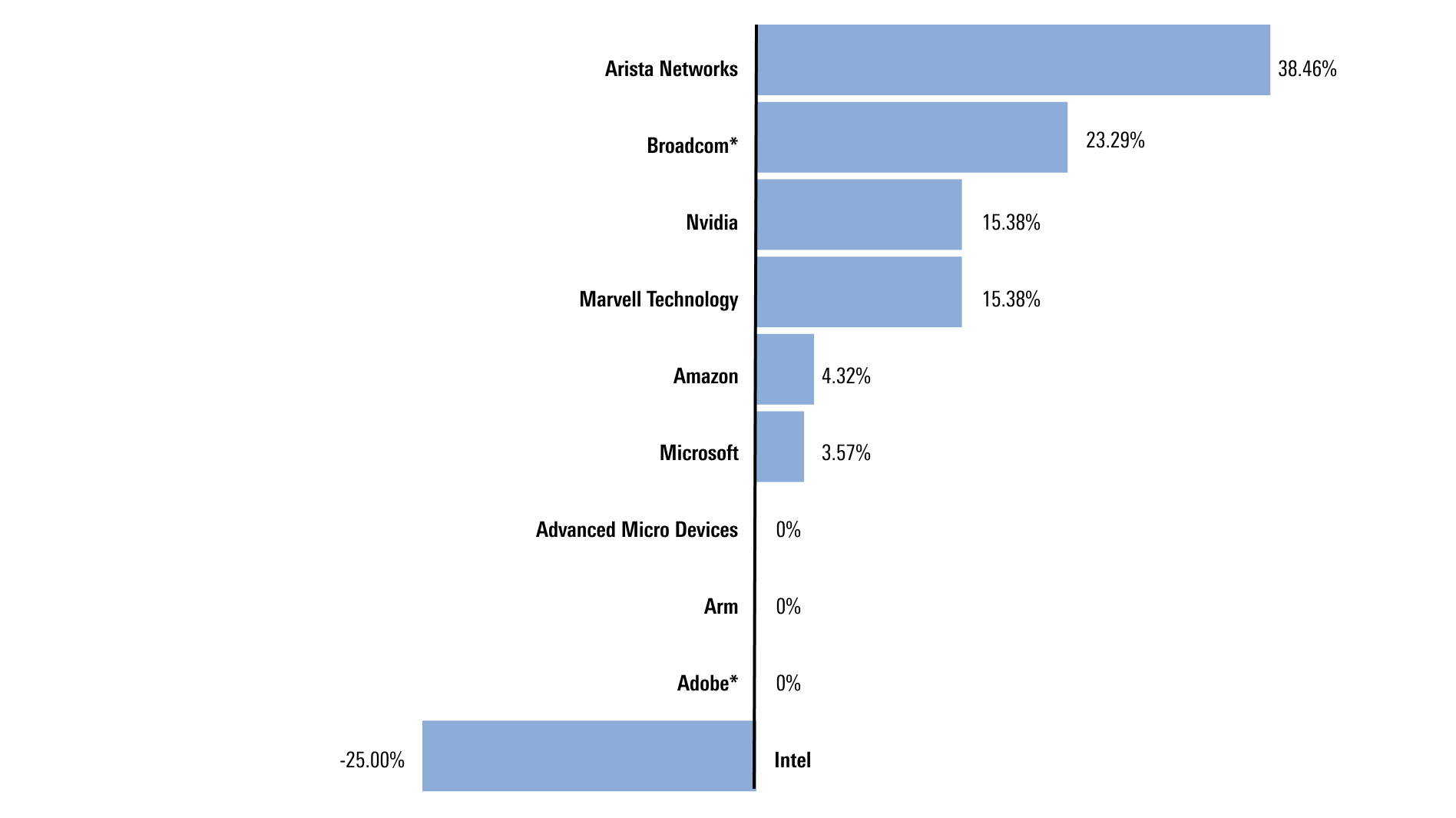

Fair Value Estimate Changes

Morningstar analysts raised their fair value estimates on six of the ten stocks highlighted here, with Arista seeing the largest jump of 38%. Broadcom reports earnings on June 12, but the stock has already experienced the second-largest valuation increase this earnings season, at 24%. Three stocks—AMD, Arm, and Adobe (which reports on June 13)—did not see their fair value estimates change. Only Intel had its fair value estimate cut.

Morningstar Fair Value Estimate Change During Q1 Earnings Season

According to Morningstar analysts, the main driver of the raised fair values is continued demand strength. “Much of the generative AI growth story for the main players seems to be de-risked through 2025 after Nvidia’s latest earnings report and commentary on demand exceeding supply through all of next year,” says Morningstar director of equity research Eric Compton. “Microsoft and Amazon have benefitted in the last two quarters from an uptick in AI-related demand on their public cloud services. As a result, they are ramping up capital expenditure on AI inference capacity. We expect generative AI to remain a modest tailwind for the rest of this year.”

These fair value increases are modest compared with the last earnings season. After fourth-quarter 2024 earnings, seven of the stocks on our watchlist saw double-digit percentage raises, with Nvidia’s fair value estimate increasing by 52%.

Opportunities to Invest In AI Stocks

Seven of the 10 companies highlighted here are fairly valued, while two are overvalued. Only Adobe is undervalued.

On the whole, Compton says many AI-related valuations look high. “We struggle with valuations for the memory demand plays (Micron MU, Western Digital WDC, Seagate STX), AI server plays (notably Dell DELL), some of the networking plays (Broadcom), and others semiconductor plays (Qualcomm QCOM and Texas Instruments TXN),” he says.

For investors looking to buy AI stocks, he sees the best opportunities in Nvidia, the auto industry, and software: “With Nvidia still in 3-star territory (roughly fairly valued), compared with some other overvalued AI-related plays, we think Nvidia remains a decent relative AI bet.”

In the auto industry, recent headwinds have driven share prices into undervalued territory. “We think fears are overblown on these names,” says Compton. “Eventually the auto cycle will turn, but they are forgotten while everyone is focused on the AI plays. Here we like STMicroelectronics STM, Infineon IFNNY, and Sensata ST.” Those stocks are all trading at double-digit discounts to their fair value estimates.

Compton continues: “Within software, we like Adobe, which we think sold off too far after fourth-quarter 2023 earnings and remains cheap and well-positioned competitively. We also like several cybersecurity names, with Fortinet FTNT at a price/fair value ratio of 76% and Palo Alto PANW at 80%. We like the overall demand backdrop for cyber names, and see multi-year demand tailwinds still at play, particularly for the larger players.”

Here’s what Morningstar analysts say about the stocks on our AI watchlist.

Adobe

- Fair Value Estimate: $610.00

- Economic Moat: Wide

- Morningstar Rating: 4 stars

Adobe, which reports on June 13, has not seen any change to its fair value estimate so far this earnings season. “Adobe’s generative AI solution, Firefly, continues to attract strong interest, with 6.5 billion generations already in less than a year,” says Morningstar senior equity analyst Dan Romanoff. “It is easy to see how Adobe Express and Firefly are widening the funnel for new customers, and we think this bodes well for growth over the next several years. We see plenty of momentum within product innovation, client interest, and revenue creation.”

Advanced Micro Devices

- Fair Value Estimate: $145.00

- Economic Moat: Narrow

- Morningstar Rating: 2 stars

Advanced Micro Devices saw no change to its $145 fair value estimate following first-quarter earnings. “The company’s forecast for 2024 was modestly disappointing as I suspect that many investors were expecting AMD to boost its AI GPU revenue target once again to something higher than its previous $4 billion target,” says Morningstar equity strategist Brian Colello. “Instead, AMD maintained its target. We think that AI GPUs will represent volatility in the stock, for better or worse, in the near term and perhaps the long term. AMD faces severe headwinds in gaming and telecom/embedded business, but these should recover in the long run. PC CPU demand is recovering on a year-over-year basis versus a dreadful start in 2023, and we think the emergence of the ‘AI PC’ might be a breath of fresh air in the PC industry over the next one to three years.”

Amazon

- Fair Value Estimate: $193.00

- Economic Moat: Wide

- Morningstar Rating: 3 stars

Amazon saw its fair value estimate bumped to $193 from $185. “The company’s second-quarter outlook was shy of our aggressive estimates, while it noted plans to materially increase data center investments in 2024 to meet generative AI demand,” says Romanoff. “Changes to our model are modest but center around continued profitability enhancements. Many positive trends from the last several quarters continued with notable improvement in AWS demand and additional cost savings arising from fulfillment and cost to serve. Strong quarterly performance has pushed the shares meaningfully higher over the last year, and as such, we see only a modest upside to our fair value for investors.”

Arista Networks

- Fair Value Estimate: $270.00

- Economic Moat: Wide

- Morningstar Rating: 3 stars

Arista saw its fair value estimate raised to $270 from $195 to account for a more aggressive medium-term AI growth forecast. “We view networking as a significant beneficiary of AI investment and see Arista as the top-positioned player in high-speed Ethernet switching,” says Morningstar equity analyst William Kerwin. “In the quarter, Arista reported strong results and raised full-year guidance by about 2%, which we believe agrees with our stronger medium-term forecast.”

Arm

- Fair Value Estimate: $57.00

- Economic Moat: Wide

- Morningstar Rating: 1 star

Arm saw no change to its $57 fair value estimate following first-quarter earnings. “By market, cloud and automotive remain the bright spots as Arm keeps gaining share thanks to its energy efficiency,” says Morningstar equity analyst Javier Correonero. “High-end smartphones lead the way in the adoption of v9, but the market is still recovering. The Internet of Things market is the main laggard, as industrial customers are going through an inventory correction.”

Broadcom

- Fair Value Estimate: $1,350.00

- Economic Moat: Wide

- Morningstar Rating: 3 stars

Broadcom, which reports on June 12, saw its fair value raised to $1,350 from $1,090 in late May. “We raise our long-term growth assumptions to factor in a greater generative AI opportunity for the firm,” says Kerwin. “Broadcom’s AI opportunity is broad and spans networking and computing. We believe its strongest opportunity is its custom accelerator business, with wins at hyperscale cloud vendors like Google GOOGL and Meta Platforms META. We believe its merchant switch and routing chip opportunity in AI is also strong, and believe Broadcom dominates these markets at the highest speeds required for building generative AI models.”

Intel

- Fair Value Estimate: $30.00

- Economic Moat: None

- Morningstar Rating: 3 stars

Intel saw its fair value estimate cut twice during earnings season. The most recent cut, to $30 from $35, came after Microsoft’s Build conference in May. “It appears that Microsoft has forged a tighter partnership in PCs with Qualcomm that we think will cause Intel to lose some market share,” says Colello.

Earlier, Colello cut the fair value estimate to $35 from $40. “First-quarter earnings and Intel’s investor event in early April signaled that the company’s emerging foundry business was less profitable than previously estimated,” says Colello. “Intel is doing the right things by focusing on manufacturing process improvement, but even if it achieves its technological hurdles, profitability on this business might be harder to achieve.”

Marvell Technology

- Fair Value Estimate: $75.00

- Economic Moat: Narrow

- Morningstar Rating: 3 stars

Marvell saw its fair value increase to $75 from $65 due to significant growth in generative AI sales. “We believe Marvell will be a significant beneficiary of investment into generative AI with diverse exposure across custom accelerators, optical chips, and merchant switch chips,” says Kerwin. “Management now sees upside to the targets provided at its AI investor day in April, which we see as positive and aligned with our bullish long-term growth thesis. Marvell’s non-AI end markets remained weak in the first fiscal quarter, but we believe AI strength will more than offset weakness elsewhere through fiscal 2025, and that softer demand is a short-term dynamic. We see Marvell as fairly valued. Investors eager to play into generative AI may see a good opportunity currently, given overvaluations of other AI beneficiaries under our coverage.”

Microsoft

- Fair Value Estimate: $435.00

- Economic Moat: Wide

- Morningstar Rating: 3 stars

Microsoft saw its fair value estimate raised to $435 from $420. “Results are impressive from most angles, but we highlight strength in AI, Azure, and gaming; a surge in bookings from large Azure deals; and robust margin performance despite downward pressure from the Activision acquisition are our key takeaways,” says Romanoff. “Artificial intelligence remains the focal point and contributed 700 basis points to Azure growth.”

Nvidia

- Fair Value Estimate: $1,050.00

- Economic Moat: Wide

- Morningstar Rating: 3 stars

Nvidia saw its fair value estimate bumped to $1,050 from $910, due to continued demand for AI accelerators. “Nvidia’s AI GPUs and GPU clusters have a dominant market position at the moment,” says Colello. “Demand continues to outpace our prior expectations and we think the company will see a tremendous environment where demand exceeds supply for the next 18 months. Given the introduction of Nvidia’s next-generation Blackwell GPUs, which may carry higher prices than the previous generation products, Nvidia’s prospects remain bright. We think the latest, recent runup in the stock price is justified and we view Nvidia as fairly valued today.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/COBD5LTAVZFGZGRUMDHVLCJUG4.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-14-2024/t_47585fd168644ef0a79e2e94114ee088_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)