Should You Reconsider Dividend Funds?

New ETF choices are challenging the status quo.

Income-seeking investors have more options than ever today. Stock dividend exchange-traded funds remain alive and well, and those following sound processes are still great choices to invest in. But when it comes to income, dividends are no longer the only show in town. Interest rates have increased, making bond ETF yields more attractive and in line with their long-term historical averages. Then there is a whole new breed of covered-call ETFs that produce high income. These have exploded in popularity over the past few years.

Should income investors replace dividend ETFs with one of the other two? Each option provides solid income, but the similarities end there. They hold different underlying assets and employ different investment processes, which affects the risk/reward profile borne by investors.

To help answer that question, I break down these three distinct approaches to income and how they trade off risk and reward.

Bond ETFs

Bonds, with their interest-bearing coupons, have the ability to provide income. However, the actual distributions from bond ETFs have been moot for much of the past 15 years—a consequence of the Federal Reserve’s near-zero interest-rate policy throughout most of the 2010s. That changed in 2022, when the US central bank increased its short-term policy rate to fight inflation. One-month Treasury bills offered a nearly risk-free yield of 5.3 percentage points annualized at the end of March, and bond ETF yields followed suit. Vanguard Total Bond Market ETF’s BND trailing 12-month yield crossed 3.2% in March 2024, a yield it had not seen since mid-2011.

The stability of bond ETFs distinguishes them from dividend ETFs, but that stability is both a blessing and a curse. Generally, they provide relatively predictable income but little else. Most of a bond ETF’s total return comes from its interest or coupon payments. They rarely grow in value, and their long-term growth rate is often tepid when they do. That makes bond ETFs well-suited to reducing a portfolio’s risk and preserving wealth, but not much beyond that.

The tight relationship between price and yield dictates bond ETF performance. Yields are subject to change as the Fed adjusts its short-term policy rate to accommodate economic conditions. So, the income offered today isn’t guaranteed to persist into the future. The value of a bond ETF also moves in the opposite direction as yields. Interest rates may rise and provide higher yields, but the value of an existing bond portfolio will decline proportionally, as has been the case over the past three years.

Chasing income or yield with bond ETFs can pull investors toward murky segments of the bond market. High-yield bond ETFs harbor more credit risk and typically correlate more with the stock market than their investment-grade counterparts. That means they usually perform worse in bear markets. High-yield bonds are also difficult to trade, and the costs can add up and drag on returns. The high-yield market is one area where active management has an advantage and index-tracking ETFs are best avoided.

Dividend-Paying Stock ETFs

Dividend ETFs, specifically those oriented toward income, solve two problems facing bond investors: inconsistent long-term yields and low growth of principal. Like bonds, well-constructed dividend ETFs that adequately control their risks can provide fairly consistent payouts. The stocks underpinning these ETFs can grow and become more valuable over time. Such growth can lead to higher dividend payouts if yields remain steady. And those payouts aren’t subject to change with central bank policy rates. On the contrary, profitable and well-managed companies typically loathe cutting dividends.

But these qualities don’t apply to every high-dividend yield ETF. Investors have a wide range of such ETFs to choose from, and not all of them strike a reasonable balance between yield and risk management.

Dividend ETFs with relatively high yields can hold stable, high-quality companies, but not always. It’s possible that stocks offering juicy dividend payments and corresponding high yields can be immensely profitable enterprises. After all, profits should be the source of those robust payouts. But the opposite is often reality. High yields usually stem from declining stock prices that foreshadow deteriorating profits and fundamentals. Ironically, the highest-yielding companies are usually those facing shaky business conditions and fading profits.

The highest-yielding dividend ETFs should be avoided because they face two related risks. First, the deteriorating nature of their underlying stocks means they may not grow at a reasonable rate over the long term. Along those lines, they may be more volatile than the market and subject to deeper drawdowns, which compromises their long-term growth.

Second, their flimsy fundamentals mean that dividend cuts may lie on the horizon. Companies reduce or sometimes eliminate dividends to preserve cash when business conditions sufficiently deteriorate. And dividend ETFs that pursue such stocks may have to churn through their holdings when dividend payouts dry up. That increases turnover and trading costs.

Instead, investors should favor dividend ETFs with reasonably higher yields than the market that intentionally control their exposure to unstable companies. Vanguard High Dividend Yield ETF VYM and Schwab US Dividend Equity ETF SCHD consistently rank as Morningstar’s favorites among high-dividend-yield ETFs because they strike a good balance between yield and risk. Both earn Morningstar Medalist Ratings of Gold.

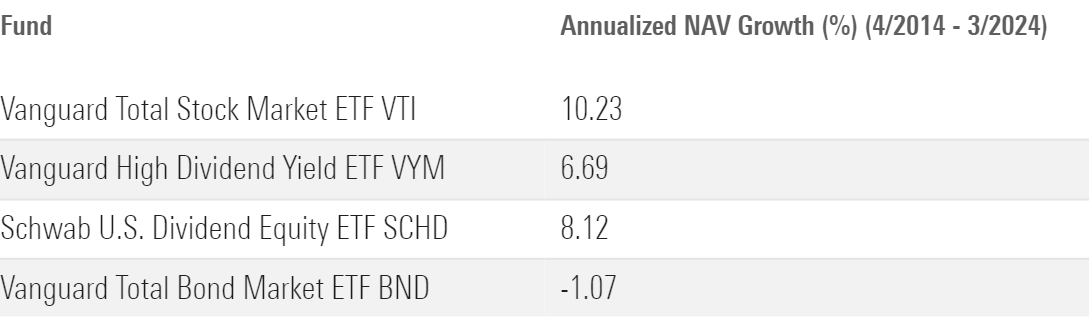

The exhibit below shows that the growth of each ETF’s net asset value over the trailing 10 years through March wasn’t as high as the broader stock market (as proxied by Vanguard Total Stock Market ETF VTI). However, it was considerably more attractive than Vanguard Total Bond Market ETF over the same period, which suffered when interest rates increased in 2022 and 2023.

Long-Term Growth Benefits Dividend ETFs

Covered-Call ETFs

Covered-call ETFs, like Bronze-rated JPMorgan Equity Premium Income ETF JEPI, are the third type of income ETF currently available. These ETFs are more complicated than the first two options, and the underlying investment process is far from novel. Options traders have used covered-call strategies for decades to generate income, making them well suited for income-oriented investors. JPMorgan Equity Premium Income ETF’s trailing 12-month yield weighed in at 7.55% at the end of March, compared with 2.82% for Vanguard High Dividend Yield ETF.

The options that underpin these ETFs make performance patterns harder to understand than traditional investments. The income they throw off doesn’t come from dividends or interest. Instead, the ETF sells call options against its underlying stock portfolio and collects a premium that it distributes to investors. Those premiums fluctuate over time based on interest rates and market conditions, but the payouts can be lucrative relative to the dividends offered by stocks.

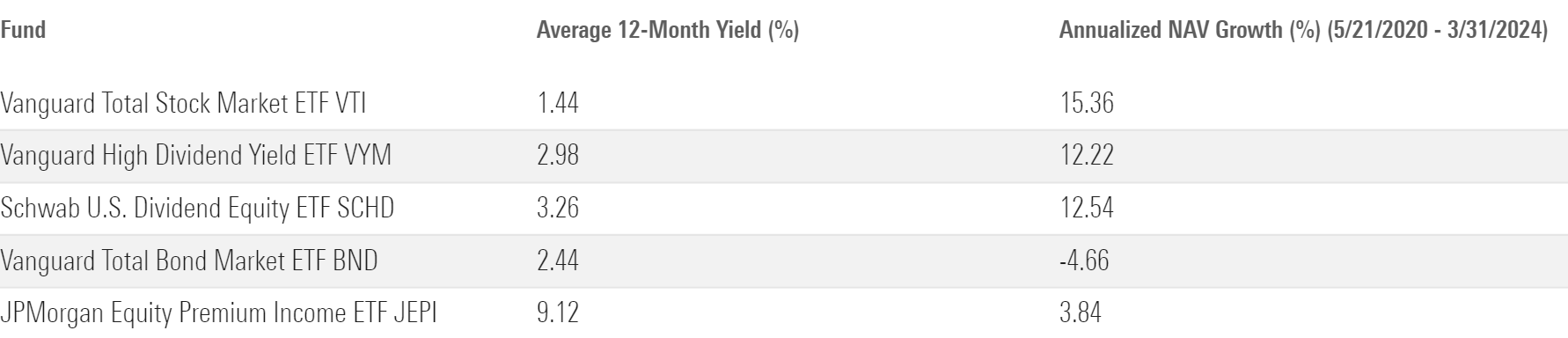

There is a catch. Selling call options effectively limits the growth of the underlying stock portfolio. The ETF will have to pay those who purchased its call options when the value of the underlying stocks grows above the option strike price. Said another way, the growth of the underlying stock portfolio will likely be limited during bull markets. The trade-off effectively boils down to a higher yield but a lower long-term NAV growth rate relative to a dividend ETF. The next exhibit shows what that trade-off has looked like over the past several years for Vanguard Total Stock Market ETF, Vanguard High Dividend Yield ETF, Schwab US Dividend Equity ETF, Vanguard Total Bond Market ETF, and JPMorgan Equity Premium Income ETF.

JEPI Swaps Growth for Yield

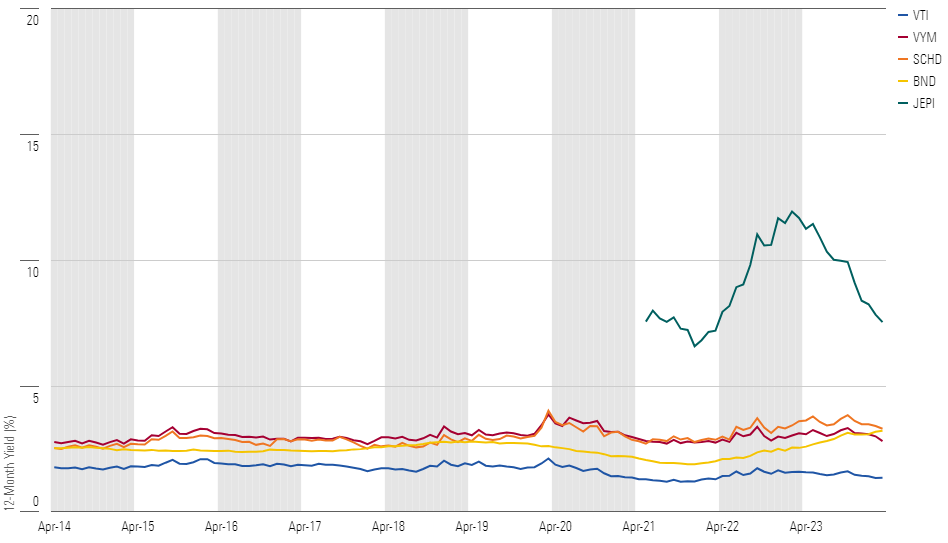

The average yields in the exhibit mask another risk that’s inherent to covered-call ETFs: The yield or income they provide can fluctuate wildly compared with stock or bond ETFs. The following exhibit shows the trailing yields for the ETFs listed in the exhibit above. JPMorgan Equity Premium Income ETF provided a considerably higher yield than the others, but it varied within a much wider range. Its trailing 12-month yield measured as low as 6.6% at the end of 2021 before it doubled to almost 12% 14 months later. Likewise, its monthly distributions have ranged from about $0.26 to $0.62 per share. Investors considering JPMorgan Equity Premium Income ETF or others like it should be prepared for large swings in the income they receive.

Trailing Yield of Income ETFs

What’s to make of all this? Bond ETFs are great for income investors who primarily want to preserve wealth or cut back on risk. Dividend ETFs are better suited for those who want to tap into the stock market’s growth, but the value of these ETFs will bear the market’s ups and downs. The income from covered-call ETFs is the highest, but the underlying portfolio won’t grow by much and the level of income is subject to large swings. The ETFs mentioned before—Vanguard Total Bond Market ETF, Vanguard High Dividend Yield ETF, Schwab US Dividend Equity ETF, and JPMorgan Equity Premium Income ETF—are good choices to start with in their respective categories.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VPCBITMQP5FKLIZ32POIXOV3MQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)