Markets Brief: Inflation Back in the Spotlight

Consumer confidence and PCE data the highlights of a shortened trading week

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

The Fed Was All Talk, Nvidia Was All Action

In a week with little economic news, financial markets had only the thin soup of the Federal Reserve Open Market Committee (FOMC) meeting minutes and associated comments to nourish their predictions about the next move in interest rates. With little new in the comments, asset prices remained steady with the Morningstar US Market index ending the week flat (-0.12%) while the Morningstar US Technology index rose 2.72%, supported by strong results from Nvidia NVDA which also announced a share split designed to attract more investors. You can find out what Morningstar’s Nvidia analyst, Brian Colello, thought about the results and the share split here.

Emerging Markets Offer Opportunities

Outside large US technology companies, investors were less sanguine, as exemplified by the Morningstar Emerging Market index which declined 1.7%% over the week, driven by weakness in Chinese stocks which fell 4.61%, partially reversing the progress we have seen in this market over the last few months. Such volatility can make it challenging to access the returns available to patient investors. It is for this reason that fundamental analysis and a focus on valuation is so important when making investment decisions. Taking this longer-term perspective, Morningstar’s research team continues to perceive opportunities in emerging markets. A summary of their latest research can be accessed here.

Will the UK Election Bring Fireworks?

Politics was back in the spotlight this week as a rain-soaked Rishi Sunak announced the UK General Election will be held on the July 4. As electioneering takes a central role in the media across the world it is natural for investors to focus on the impact of these events and some may be tempted to position their portfolio to benefit from a particular outcome. However, research conducted by the Morningstar Wealth business reminds us that politics should be treated as a range of risks to be managed rather than a source of investment returns. This is important as investors can view the outcome of an election through the lens of their own political preferences and consequently react to the results in a way that can impede their progress towards their goals.

More Inflation Data This Week

Inflation will be back in the limelight in this shortened trading week as the latest Personal Consumption Expenditure (PCE) index of consumer prices is released on Friday. According to MarketWatch, year over year inflation is expected to remain unchanged for April. A significant deviation from this outcome may create some volatility at the end of the week.

Highlights of This Week’s Market and Investing Events

- Monday, May 27 - Markets closed in observance of Memorial Day

- Tuesday, May 28 - May Consumer Confidence Survey: 95.3K vs. 97.0K in April

- Wednesday, May 29 - Federal Reserve Beige Book, Earnings from Salesforce CRM

- Thursday, May 30 - Earnings from Zscaler ZS, Costco Wholesale COST

- Friday, May 31 - April Personal Income and Outlays report, PCE inflation index (year over year): 2.7% vs. 2.7% in March

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended May 24

- The Morningstar US Market Index fell 0.14%.

- The best-performing sectors were technology, up 2.72%, and industrials, down 0.48%.

- The worst-performing sector was energy, down 3.59%.

- Yields on 10-year US Treasury notes rose to 4.46% from 4.42%.

- West Texas Intermediate crude prices fell 4.80% to $77.74 per barrel.

- Of the 703 US-listed companies covered by Morningstar, 177, or 25%, were up, 2 were unchanged, and 524, or 75%, were down.

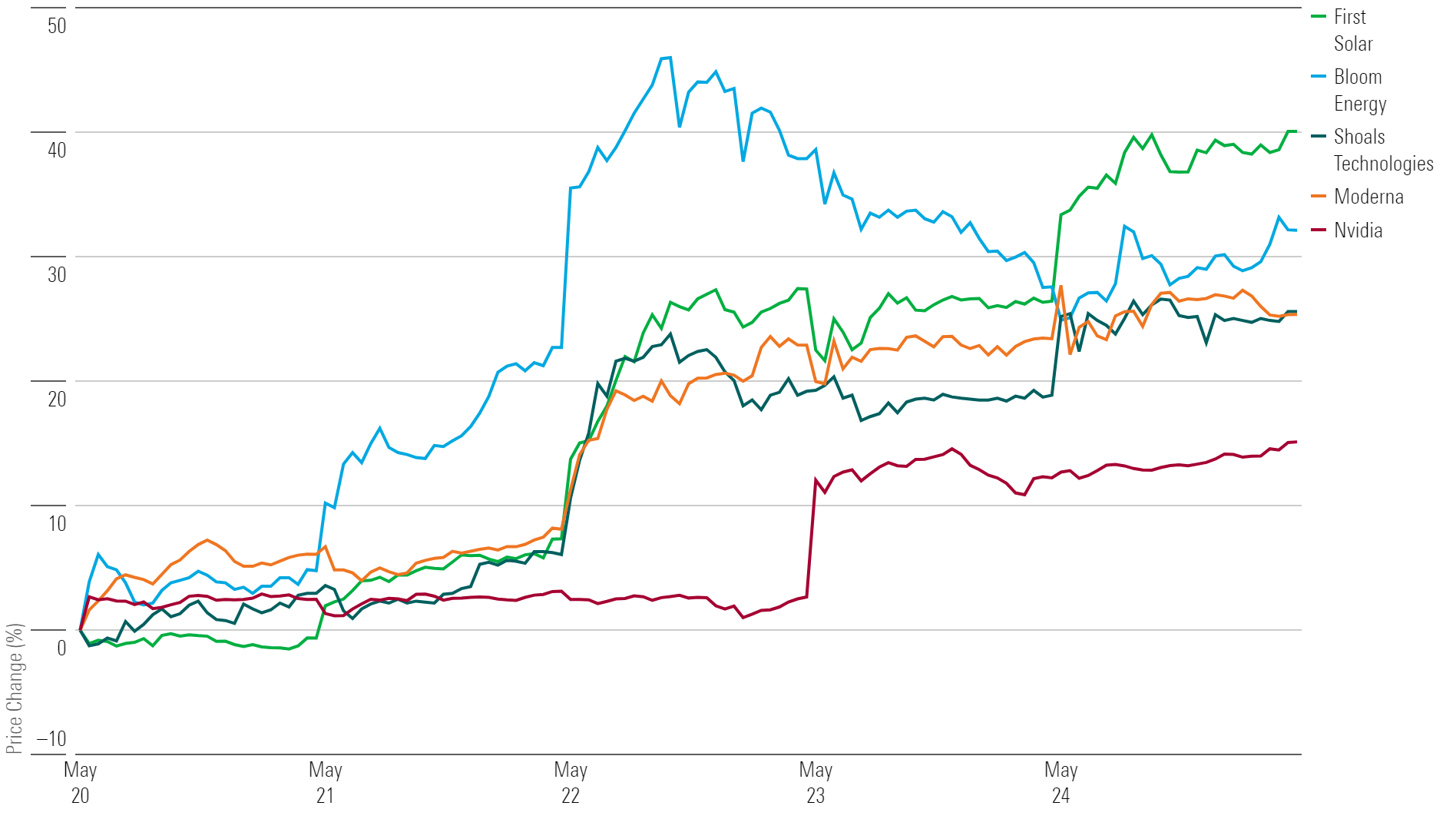

What Stocks Are Up?

First Solar FSLR, Bloom Energy BE, Shoals Technologies SHLS, Moderna MRNA, and Nvidia NVDA.

Best-Performing Stocks of the Week

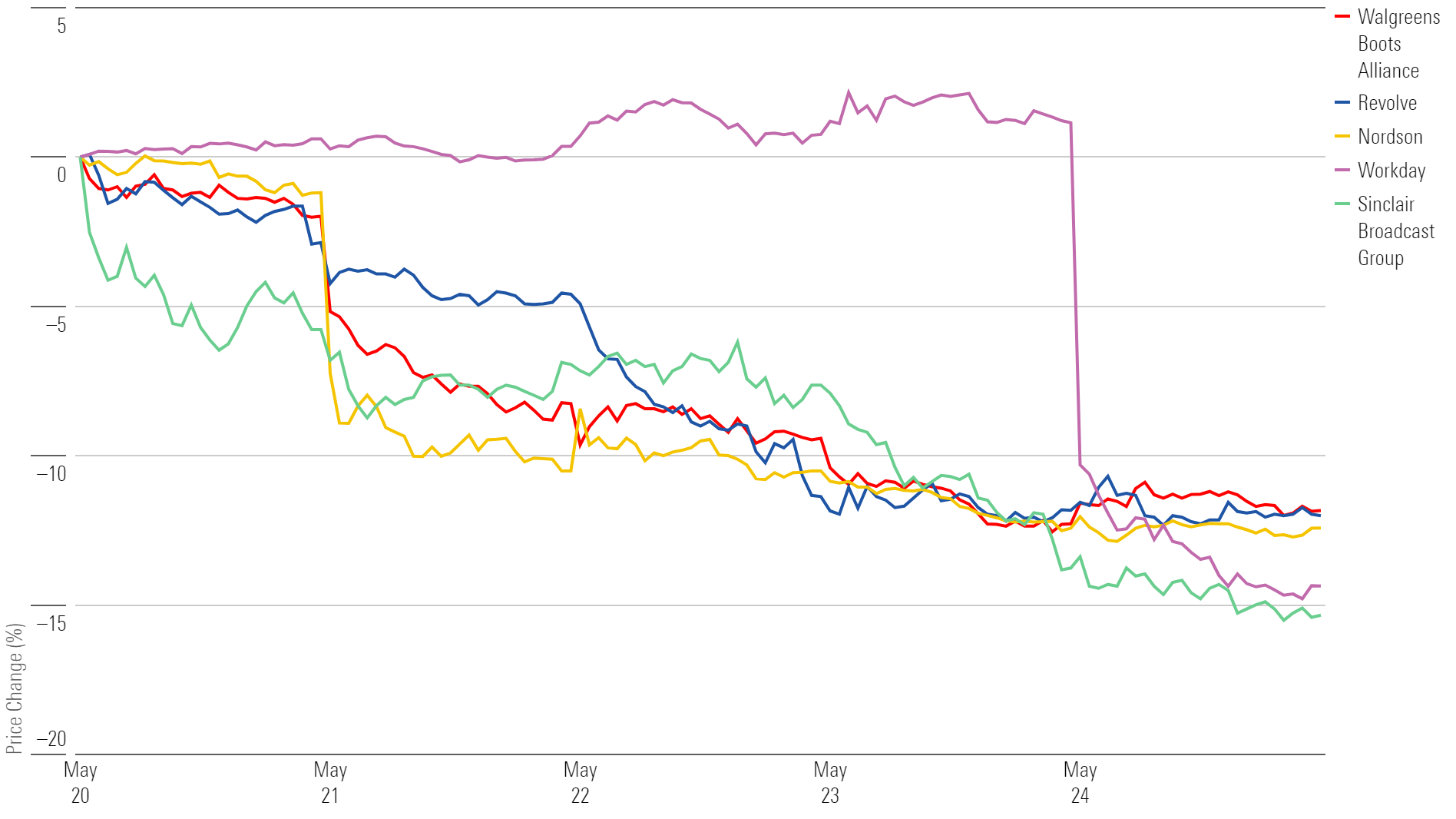

What Stocks Are Down?

Sinclair SBGI, Workday WDAY, Nordson NDSN, Revolve RVLV, and Walgreens Boots Alliance WBA.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/COBD5LTAVZFGZGRUMDHVLCJUG4.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-14-2024/t_47585fd168644ef0a79e2e94114ee088_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)