The Final DOL Fiduciary Rule Has Arrived. Here’s What It Means for Investors

We see the most benefits for participants in small retirement plans and investors rolling into fixed index annuities.

Knowing whether your financial advice is coming from a trusted professional or someone akin to a car salesman may soon become easier.

This week, the Department of Labor published the Retirement Security Rule. The rule redefines who qualifies as a fiduciary under the Employee Retirement Income Security Act. Put another way, the rule clarifies when financial professionals must act in the best interest of their client. The DOL also released a set of amendments to Prohibited Transaction Exemptions, which are specific requirements for fiduciaries engaging in transactions that could create a conflict of interest.

We believe this rule will have significant benefits for ordinary investors. In our response to the rule, we estimated that retirement plan participants would save $55 billion over the next 10 years in fees, and investors rolling over into annuity products could save another $32.5 billion over the same period. These estimates are in undiscounted, nominal dollars.

The New DOL Fiduciary Rule in Short

The rule covers cases where an investor is saving for retirement through a workplace retirement plan, such as a 401(k), or other type of retirement plan, such as an IRA.

The rule introduces a new process to define who qualifies as a fiduciary. The test now includes two parts (the previous approach had five parts) and focuses on the nature of the relationship between the advice provider and the investor. The net effect: Anyone who holds themself out as a trusted advisor when providing advice will become an investment advice fiduciary, meaning they must put the investor’s interests ahead of their own.

The intent of the rule is to limit conflicts of interest and close loopholes. For example, currently, under ERISA, advice provided on a one-time basis, such as recommendations to roll assets from a retirement plan into an IRA to buy mutual funds or an annuity, are not typically considered fiduciary advice. However, as noted by the DOL in its fact sheet, one-time advice is often of critical importance for investors, as the assets in a retirement plan may constitute the investor’s life savings.

The DOL has made previous attempts to promulgate a new fiduciary rule, first introducing a proposal in 2010. The next attempt was made by the Obama administration in 2016. While the 2016 rule did go into effect, it was struck down by an appeals court in 2018. This new rule was introduced far enough in advance of the next election that, even if there is a change in administration, it will be difficult for a potential new administration to undo the rule in January. However, there will certainly be litigation, so it is unclear if the rule will stick in the long run.

Assuming the rule is here to stay, many investors could be affected. However, we see the most benefit for two types of investors:

- Investors in small retirement plans

- Investors rolling assets into a fixed index annuity

We focus on these cases because the impact is likely to be significant and other situations are often already covered by similar standards. Advice to individuals on traditional investments and variable annuities and registered-index linked annuities (including rollover scenarios) are generally already covered by the SEC’s Regulation Best Interest, which went into effect in 2020 (though it does not address advice on these products to plan sponsors).

While recommendations on fixed-rate annuities (also known as multiyear guarantee annuities) and income annuities are affected by the new rule, we do not think investors will realize as significant of savings because commissions on these products are already relatively low.

Impact of the Fiduciary Rule on Participants in Small Retirement Plans

Our impact analysis of the rule found that for retirement investors participating in a workplace retirement plan:

- Average costs for workers covered by a small plan would drop to 75 basis points from 93 basis points, while there would be minimal changes for most other plans.

- Participants would save over $55 billion in the first 10 years and over $130 billion in the subsequent 10 years, in undiscounted and nominal dollars.

- Over 80% of these savings would be experienced by small-plan participants, of which there are currently more than 20 million.

We believe that investors in smaller retirement plans will benefit greatly from the new rule as these investors pay considerably more than their luckier counterparts at larger companies with larger plans.

In fact, as we reported in the 2023 Retirement Plan Landscape Report, participants in small plans—those with less than $25 million in assets—pay nearly twice as much as participants in larger plans, based on the median reported fees as a percentage of assets under management in publicly available disclosures.

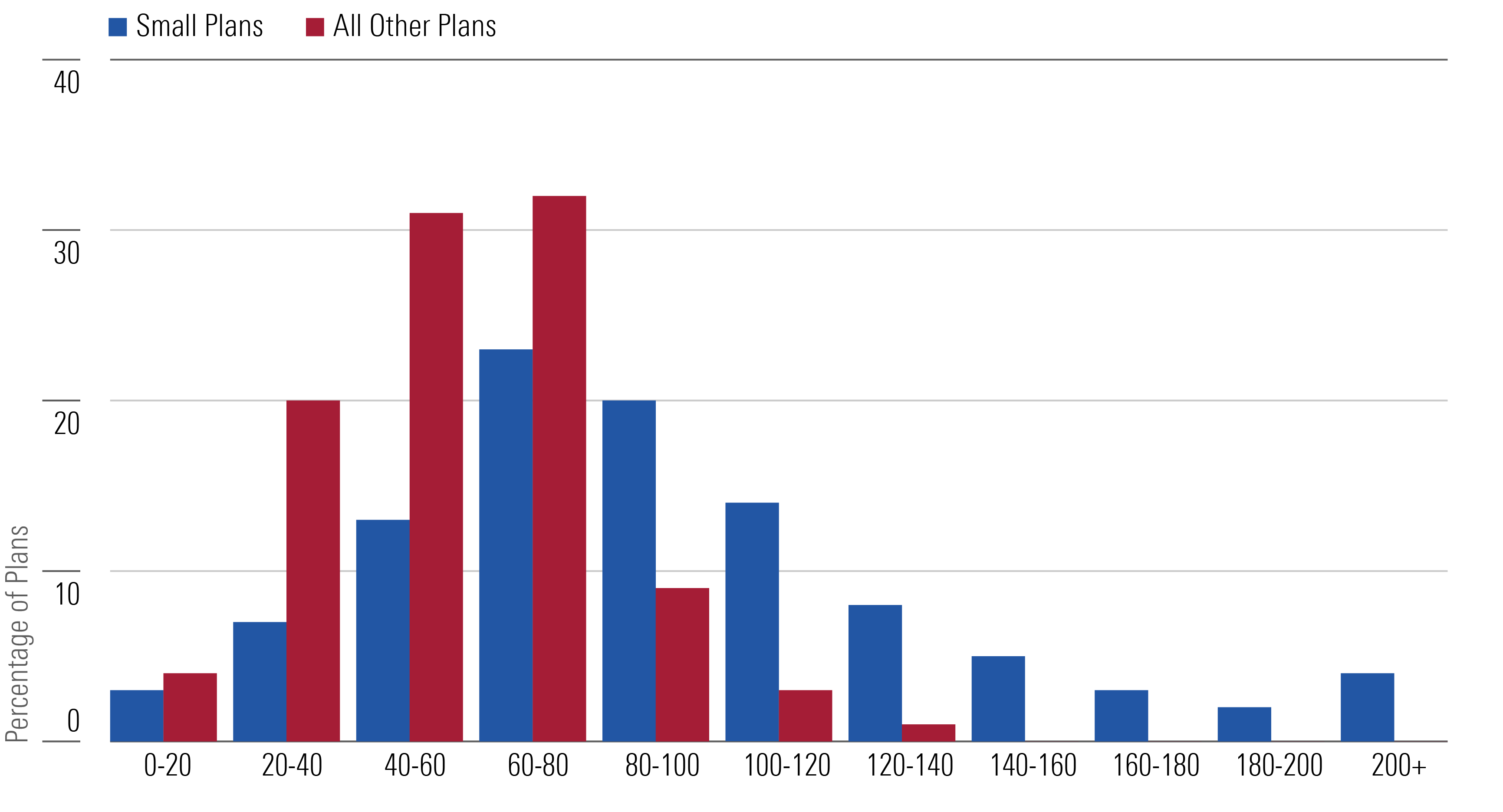

Of course, some of that gap is because, on an assets-under-management basis, smaller plans with lower levels of investable assets pay more as a percentage of their assets for administrative and recordkeeping services than are often charged on a per participant basis at larger plans. Nonetheless, smaller plans also have a much higher range of fees, as shown in the exhibit below, which suggests many plans pay unreasonably high fees.

Total Costs Participants Pay to Invest in Defined-Contribution Plans

In particular, some of the investment fees participants pay look outlandish compared with the investment universe. We believe that the new rule and requirements around prohibited transaction exemptions will result in plan fiduciaries examining their investment lineups and the fees their investments charge. Firms that aid plan sponsors in the construction of their plan lineups—and that would newly be considered fiduciaries under the new rule—will need to comply with the amended PTEs to receive compensation that would otherwise be prohibited. In doing so, they will need to ensure their recommendations are prudent and their fees are reasonable.

Plans that currently have significantly above-average costs are unlikely to meet these standards, which may lead to changes in the plan lineup. For example, the fees investors pay purely for investment management are much, much lower than what is commonly found in small plans. Across all mutual funds and exchange-traded funds, the asset-weighted average net expense ratio that investors pay is just 0.37%.

When the scope is narrowed to just “unbundled” share classes that Morningstar tracks—which are mutual funds and ETFs in which the expense ratio does not include additional charges for administrative expenses that are paid to a third party for services—the fees are even lower, as shown in the table below. We show the amounts for target-date funds, which are commonly used by retirement investors, and all other funds.

Average and Median Expenses for Unbundled Mutual Funds in 2023 (in Basis Points)

| Asset-Weighted Average Expense Ratio | Median Expense Ratio | |

|---|---|---|

| Target Date | 1 | 32 |

| Other Funds | 14 | 59 |

| All Funds | 14 | 54 |

Of course, plans must pay for administrative expenses such as recordkeeping, and we do not expect them to deliver all-in costs that only reflect the costs of investment management to the extent that participants pay administrative expenses on an assets-under-management basis. But, given the costs of investment management, we do not believe that, even with administrative expenses, any US plan or its fiduciary would feel comfortable maintaining a plan with more than, say, 100 basis points in fees to participants, given how common it is to pay much less.

Taken together, we think that investors participating in an expensive small workplace retirement plan will see fees drop. If the average cost for the 20 million workers covered by a small plan drops even just 18 basis points from the current average of 93, participants will save billions of dollars.

Impact of the Fiduciary Rule on Investors Rolling into Fixed Index Annuities

We believe that the rule will likely lead to significant savings for retirement investors rolling into fixed index annuities, because these products are not currently covered by the SEC’s Regulation Best Interest. According to our analysis, retirement investors rolling into fixed-index annuities will save over $32.5 billion in the first 10 years and over $32.5 billion in the subsequent 10 years, in undiscounted and nominal dollars.

Although most fixed-index annuities do not have any explicit fees, the investor still pays in the form of lower returns (credited interest rates). This is how the insurance company pays commissions and covers their own costs to distribute the product. When the new rule goes into effect, we think fixed-index annuity commissions will decrease due to insurance producers following the impartial conduct standards. This will result in lower implicit costs, leading to better returns for investors.

We also believe the new rule will likely result in lower surrender fees paid by investors when liquidating an annuity. Since the recommendations to purchase these products will need to be in the investor’s best interests, the products that are bought should better fit with the investor’s circumstances and preferences.

What’s Next for the DOL Fiduciary Rule

We expect these rules to bring about substantial benefits to retirement investors, but they will not materialize overnight.

The first challenge will be overcoming the expected lawsuit. While none have been filed at the time of publishing this article, multiple trade groups have criticized the final rule, and the consensus is that a legal challenge will arrive before long. Barring any legal intervention, the rules will take effect on Sept. 23, 2024, with some of the requirements and PTEs delayed until September 2025.

Data to evaluate the effectiveness of the regulation will arrive with a greater lag. For example, to assess the impact on small plans and the workers they serve, we’ll need data from an annual regulatory filing that generally doesn’t become available until October of the following year. That would be October 2026 at the earliest, but October 2027 for a more complete picture of rule-driven changes.

While we wait for the data to draw a conclusive verdict—and monitor the legal landscape for any delays in implementation—we anticipate a net positive impact from this regulation for investors.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/478a471a-aa07-4241-afd4-40cf325f3951.jpg)

/s3.amazonaws.com/arc-authors/morningstar/f3c31470-cc00-45ac-b20f-d2928ec12660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BZ4OD6RTORCJHCWPWXAQWZ7RQE.png)

/d10o6nnig0wrdw.cloudfront.net/06-17-2024/t_1031cd7a71b24d98b6d2755a60c75a07_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/478a471a-aa07-4241-afd4-40cf325f3951.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f3c31470-cc00-45ac-b20f-d2928ec12660.jpg)