5 Cheap Stocks Leading the Low-Carbon Transition

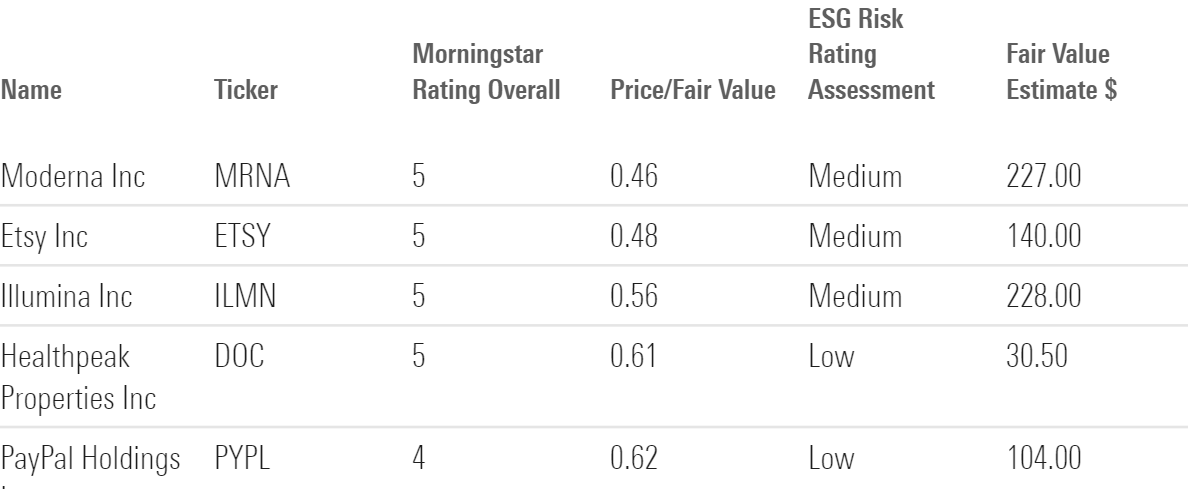

Moderna, Etsy, Illumina, Healthpeak Properties, and PayPal Holdings are trading below their fair value estimates.

Investors seeking companies committed to the low-carbon transition may find Moderna MRNA, Etsy ETSY, Illumina ILMN, Healthpeak Properties DOC, and PayPal Holdings PYPL worth exploring. In this article, we look at companies that have displayed a commitment to reducing their carbon intensity while also reporting their carbon transmissions and overall contributing positively to the environment.

Morningstar US Low Carbon Transition Leaders Index

We found these companies by scouring the holdings in the Morningstar US Low Carbon Transition Leaders Index. The index comprises 181 equity holdings, with 47% in the 10 largest stocks. Nvidia NVDA commands the highest portfolio weight at nearly 13%, followed by industry giants like Microsoft MSFT, Alphabet GOOG, Eli Lilly LLY, and JPMorgan JPM.

The index, launched on Feb. 28, 2024, is designed to offer diversified exposure to companies leading the charge in carbon reduction. The companies are ranked according to their carbon intensity and Low-Carbon Transition Ratings from Morningstar Sustainalytics. The index also seeks to emphasize companies that report carbon emissions and are reducing their carbon intensity, as well as those whose business activities contribute positively to the environment.

Morningstar tracks performance from June 19, 2020. So far in 2024, the Morningstar US Low Carbon Transition Leaders Index has returned 11.24% versus SPDR S&P 500 ETF Trust’s SPY 9.45% return. In 2023, the index returned 27.5% versus SPY’s 24.0% gain.

We looked for companies within this index with the lowest price/fair value estimates.

5 Cheap Stocks Leading the Low-Carbon Transition

Moderna

Price as of April 12, 2024: $105.19

Moderna’s revenue plunged 64% to $6.8 billion in 2023 because of lower demand for the covid-19 vaccine. The stock is trading at a 54% discount to its fair value estimate.

“The pandemic accelerated Moderna’s evolution into a commercial-stage biotech, and we expect that the firm’s ramp-up in manufacturing and clinical know-how will pave the way for faster timelines for additional programs,” writes Morningstar strategist Karen Andersen. “Moderna’s mRNA platform, involving rapid design and similar manufacturing across programs, allows the company to pursue multiple programs in parallel. Moderna also retains full rights to most of its programs, although partnerships with Merck and Vertex help support its efforts in oncology and cystic fibrosis.”

Andersen adds that Moderna is likely to launch a combination flu and covid-19 vaccine in 2025, which could help pull demand for covid-19 vaccines slightly closer to the annual 150-million-dose demand for flu vaccines in the United States.

Etsy

Price as of April 12, 2024: $67.05

Etsy dominates a niche, connecting buyers and sellers through an online market to exchange vintage and craft goods. The stock is trading at a 52% discount.

“As the firm works to improve its value perception and its unprompted brand awareness, and as it rolls out a suite of operational improvements like gift mode and a planned loyalty program, we see a viable route to mid-single-digit growth in average annual per buyer spending over the decade to come,” writes Sean Dunlop, a senior analyst at Morningstar.

Dunlop adds, “We believe wide-moat Etsy offers compelling value for investors despite a brutal 2023, which has seen its share price fall by a striking 45%.”

Illumina

Price as of April 12, 2024: $127.07

Illumina provides tools and services to analyze genetic material with life science and clinical lab applications. The company generates over 90% of its revenue from sequencing instruments, consumables, and services. The stock trades at a 44% discount.

“Currently, we remain unconvinced that emerging systems will fully dethrone Illumina’s sequencing technologies, given the switching costs associated with its large installed system base and its own new commercialization efforts,” writes Morningstar senior analyst Julie Utterback.

Utterback adds, “Since purchasing Solexa with its Genome Reader instrument in 2007, Illumina’s continued innovation significantly reduced the cost of sequencing, thereby enabling the rapid expansion of sequencing applications.”

Healthpeak Properties

Price as of April 12, 2024: $18.52

Healthpeak owns a diversified healthcare portfolio of approximately 459 in-place properties spread across mainly medical office and life science assets, plus a handful of senior housing, hospital, and skilled nursing/post-acute-care assets, as well. The stock trades at a 39% discount.

“The baby boomer generation is starting to enter its senior years, and the 80-plus population, an age range that spends more than 4 times on healthcare per capita than the national average, should almost double in size over the next 10 years,” writes Morningstar senior equity analyst Kevin Brown in his report. “Long term, the best healthcare companies are well-positioned to take advantage of these industry tailwinds.”

Brown adds, “The company may face environmental, social, and governance risks that would negatively affect its portfolio or cash flows. These include properly maintaining the safety of the buildings across the portfolio, paying a competitive wage to employees, and accounting for the future impact of climate change.”

PayPal Holdings

Price as of April 12, 2024: $64.59

PayPal provides electronic payment solutions to merchants and consumers, focusing on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform. The stock is trading at a 38% discount to its fair value estimate.

“Fintech innovation also appears to be concentrated in the e-commerce space, which has given rise to some new competitors,” writes Morningstar senior analyst Brett Horn in his report. “On the consumer side, services such as Apple Pay represent competition for PayPal. Competition on both sides could chip away at PayPal’s position. On the other hand, PayPal remains a preferred partner in the online space. Its Braintree business is growing rapidly, and PayPal could build a growing presence in in-person transactions. In balance, we think the company can hold its own, but we recognize the potential to veer in either direction.”

Horn adds, “Alex Chriss took over as CEO in September 2023. Chriss seems like a solid choice; he previously managed Intuit’s small-business and self-employed group, which accounts for most of that company’s revenue. We don’t expect dramatic changes after Chriss takes over.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MGEDEFIRZJFHTAFNLDHG46SDXI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3WSI3CQP7FA6PNS52T4WTZ27VU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VSMLFOHJRVBK5L2JAJXUPP274Q.png)